The Divisional Head SAM opportunity stands as a pivotal leadership position within The Bank of Punjab (BOP), inviting seasoned professionals to drive strategic risk management. This key role, based in Lahore, seeks an Executive Vice President equivalent to strengthen the institution’s robust Risk Management Group.

Rewarding Your Expertise

Prospective candidates can anticipate a truly market-based competitive remuneration package for this challenging role. This compensation reflects the significant responsibilities and the high-impact contributions expected from the selected individual.

Unlock Real Career Growth

Beginning your journey with The Bank of Punjab means joining an organization with over 35 years of profound presence and rapid expansion. Operating through a vast network of more than 900 real-time online branches and ATMs nationwide, The Bank offers unparalleled reach and operational scale.

This institution has diligently built a strong foundation, consistently delivering premium banking services with an unwavering focus on unsurpassed value for its customers. The Bank’s progression strategy actively seeks dedicated and performance-driven professionals to contribute to its advanced solutions and continued success.

Joining the team offers a dynamic environment where skills are honed and professional development is a priority. Candidates gain invaluable experience within a fast-growing financial entity committed to innovation and service excellence.

Your Strategic Role Unveiled

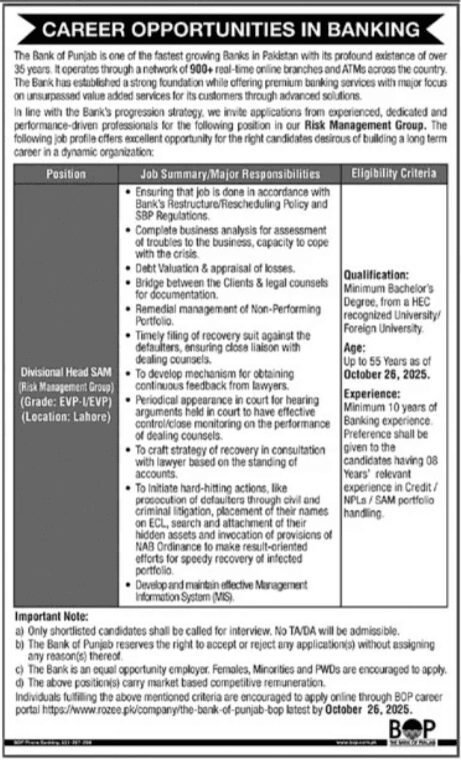

This critical leadership role demands strict adherence to The Bank’s established procedures and State Bank of Pakistan (SBP) regulations, ensuring financial compliance and stability. It involves intricate business analysis to assess potential troubles and evaluate a business’s capacity to navigate crises.

Moreover, responsibilities further extend to meticulous plant valuation and the precise appraisal of losses, critical for informed decision-making. The individual will act as a vital bridge between clients and legal counsels, facilitating comprehensive documentation processes.

The role’s core mission centers on the remedial management of non-performing portfolios, aiming for swift and effective recovery. This requires a proactive approach to safeguard the institution’s assets.

Key responsibilities for this opportunity include:

- Liaising efficiently with clients and legal counsels to complete all necessary documentation.

- Actively managing non-performing portfolios through effective remedial strategies.

- Promptly filing recovery suits against defaulters, maintaining strong coordination with dealing counsels.

- Developing mechanisms for continuous feedback and performance monitoring of legal representatives.

- Periodically appearing in court to oversee hearing arguments, ensuring robust control over legal proceedings.

- Crafting bespoke recovery strategies in collaboration with lawyers, considering account standing.

- Initiating forceful recovery actions like civil/criminal litigation, asset attachment, and regulatory enforcement.

- Establishing and maintaining an effective Management Information System (MIS) for comprehensive oversight.

Ideal Candidate Profile

The Bank actively seeks experienced, dedicated, and performance-driven professionals eager to build a long-term career within a dynamic financial institution. This position offers an exceptional avenue for individuals desiring to make a substantial impact.

As an equal opportunity employer, The Bank strongly encourages applications from diverse backgrounds, including females, minorities, and persons with disabilities (PWDs). Diversity enriches the team, bringing varied perspectives to strategic risk management.

Simple Eligibility Check

Applicants must possess a minimum Bachelor’s Degree obtained from a university recognized by the Higher Education Commission (HEC) or an accredited foreign institution. This foundational academic requirement ensures a strong intellectual base for the demanding responsibilities.

Beyond academic qualifications, candidates should be no older than 55 years as of October 26, 2025, demonstrating relevant career progression. A robust background in banking is essential for this senior managerial role.

Specific qualifications include:

- Minimum Bachelor’s Degree from an HEC Recognized University or accredited Foreign University.

- Age limit: up to 55 years as of October 26, 2025.

- Minimum 10 years of overall banking experience.

- Preference for candidates with at least 8 years of relevant experience in Credit, Non-Performing Loans (NPLs), or Special Asset Management (SAM) portfolio handling.

Your Application Journey

Individuals fulfilling the stringent criteria previously outlined are strongly encouraged to submit their applications promptly. This is a chance to advance your professional trajectory within a leading financial organization.

The application process is entirely online via The Bank of Punjab’s dedicated careers portal on Rozee.pk, ensuring convenience and efficiency for all prospective candidates. Please note that only shortlisted individuals will receive an invitation for an interview.

The Bank of Punjab reserves its inherent right to accept or reject any application without providing specific reasons. No travel allowance or daily allowance will be admissible for attending interviews in any circumstance.

Submit your application by October 26, 2025—this rapidly approaching deadline leaves limited time to seize a significant career advancement. Procrastination could mean missing out on a truly rewarding opportunity to join The Bank’s esteemed team.

“This isn’t merely a job opening; it’s a call for astute financial guardianship, where every decision shapes value and fortifies The Bank’s enduring resilience.”

Embrace this unique chance to lead vital risk management initiatives at The Bank of Punjab, contributing significantly to its sustained success. Apply diligently before the October 26 deadline, positioning yourself for substantial professional influence and personal growth.

Frequently Asked Questions

- Q: Will I be reimbursed for interview travel expenses?

- A: No, candidates attending interviews are not eligible for travel allowances or daily expenses from The Bank.

- Q: How quickly will I receive an application status update?

- A: Only candidates whose profiles precisely match the requirements will be contacted for an interview invitation.

- Q: Does The Bank guarantee filling this specific position?

- A: The Bank holds the exclusive right to decline or accept any application without providing specific reasons for its decision.