Sindh Bank Jobs 2025 – Complete Recruitment Guide for Banking Professionals

Sindh Bank Limited Job Opportunities seeks professionals for Branch Manager, Operations Manager, GBO, Cash Officer & Credit Officer roles across Pakistan. Apply online by July 14, 2025

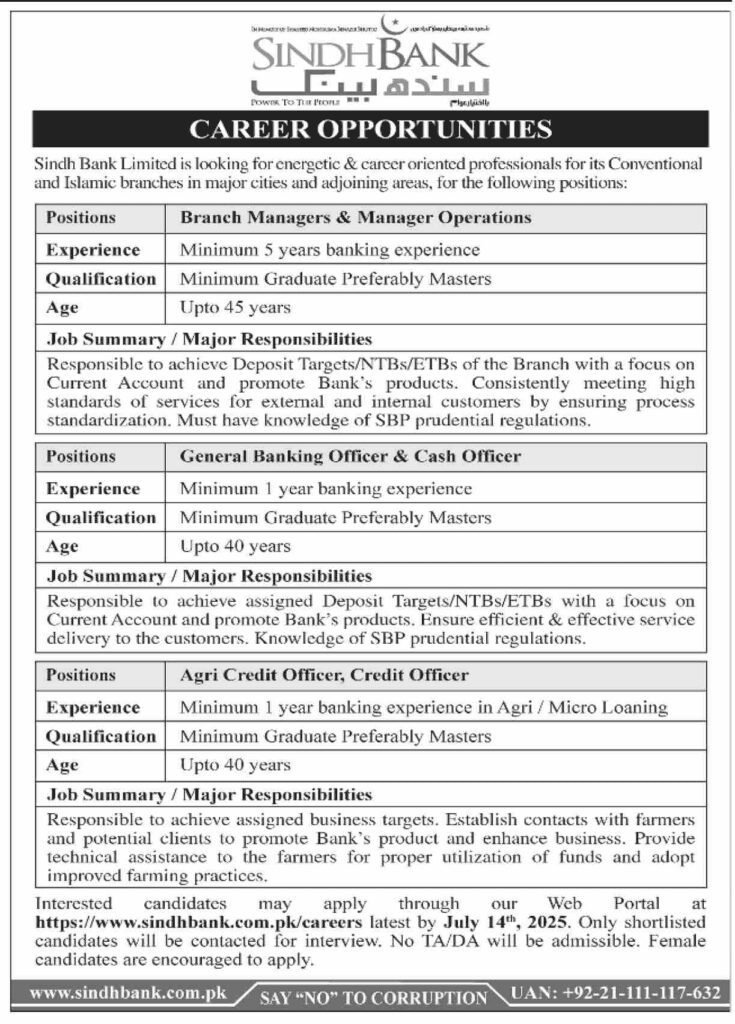

Sindh Bank Limited, a prominent name in Pakistan’s banking sector, is seeking energetic and career-oriented professionals to join its teams. The bank has announced vacancies for its Conventional and Islamic branches located in major cities and their adjoining areas. This guide provides a comprehensive overview of all available positions and the application process.

Industry Overview: The Banking Sector in Pakistan

The banking sector in Pakistan remains a dynamic and competitive field, offering stable and rewarding career paths. As a major public sector bank, Sindh Bank is committed to its mission of “Power to the People,” focusing on both commercial viability and socio-economic development. A career at Sindh Bank means contributing to an institution that plays a vital role in the national economy.

Current Market Demand

This recruitment drive highlights the banking industry’s continuous need for skilled professionals who can drive business growth and ensure exceptional customer service. The demand is particularly high for:

- Experienced Branch Leaders who can achieve ambitious deposit targets and manage branch operations effectively.

- Front-line Banking Officers who are the face of the bank and responsible for service delivery.

- Specialized Credit Officers with expertise in Agri and Micro-lending to expand the bank’s portfolio in these crucial sectors.

Required Qualifications & Vacancy Details

Sindh Bank is looking for qualified individuals for the following roles. Female candidates are highly encouraged to apply.

Branch Leadership Roles

| Positions | Experience | Qualification | Age Limit | Major Responsibilities |

| Branch Managers &<br>Manager Operations | Minimum 5 years of banking experience. | Minimum Graduate, preferably Masters. | Upto 45 years | • Achieve deposit targets (NTBs/ETBs) with a focus on Current Accounts.<br>• Promote the bank’s products.<br>• Ensure high standards of customer service.<br>• Must have knowledge of SBP prudential regulations. |

General Banking & Operations Roles

| Positions | Experience | Qualification | Age Limit | Major Responsibilities |

| General Banking Officer &<br>Cash Officer | Minimum 1 year of banking experience. | Minimum Graduate, preferably Masters. | Upto 40 years | • Achieve assigned deposit targets (NTBs/ETBs).<br>• Promote the bank’s products.<br>• Ensure efficient and effective service delivery.<br>• Knowledge of SBP prudential regulations is required. |

Credit & Lending Roles

| Positions | Experience | Qualification | Age Limit | Major Responsibilities |

| Agri Credit Officer &<br>Credit Officer | Minimum 1 year of banking experience in Agri / Micro Loaning. | Minimum Graduate, preferably Masters. | Upto 40 years | • Achieve assigned business targets.<br>• Establish contacts with farmers and potential clients.<br>• Provide technical assistance to farmers for proper fund utilization and improved farming practices. |

Application Process: Your Step-by-Step Guide

The application process is entirely online. Follow these steps to apply:

- Visit the Sindh Bank Careers Portal:

- Navigate to the official careers page on the Sindh Bank website:

- https://www.sindhbank.com.pk/careers

- Find and Select the Position:

- Browse the available vacancies and select the role that matches your qualifications and experience.

- Complete and Submit Your Application:

- Fill out the online application form with accurate and up-to-date information.

- Submit your application through the portal.

Application Deadline:

- The last date to apply is July 14th, 2025.

Please Note: Only shortlisted candidates will be contacted for an interview. No TA/DA will be admissible.

Expert Tips for Applicants

- Highlight Your Achievements: On your CV, don’t just list your responsibilities. Quantify your achievements, such as “Exceeded deposit targets by 20% for two consecutive quarters” or “Managed a loan portfolio of PKR X million with a 98% recovery rate.”

- Emphasize Knowledge of Regulations: The ad repeatedly mentions “SBP prudential regulations.” Make sure to state your familiarity with these regulations on your CV, as it’s a key requirement.

- For Agri Roles: Showcase your connection to the agricultural sector and your understanding of farmers’ needs. Any experience with rural outreach or microfinance will be a major advantage.

- Apply Early: Online portals can sometimes face issues near the deadline. It’s always best to submit your application well in advance.