- Frequently Asked Questions (FAQs)

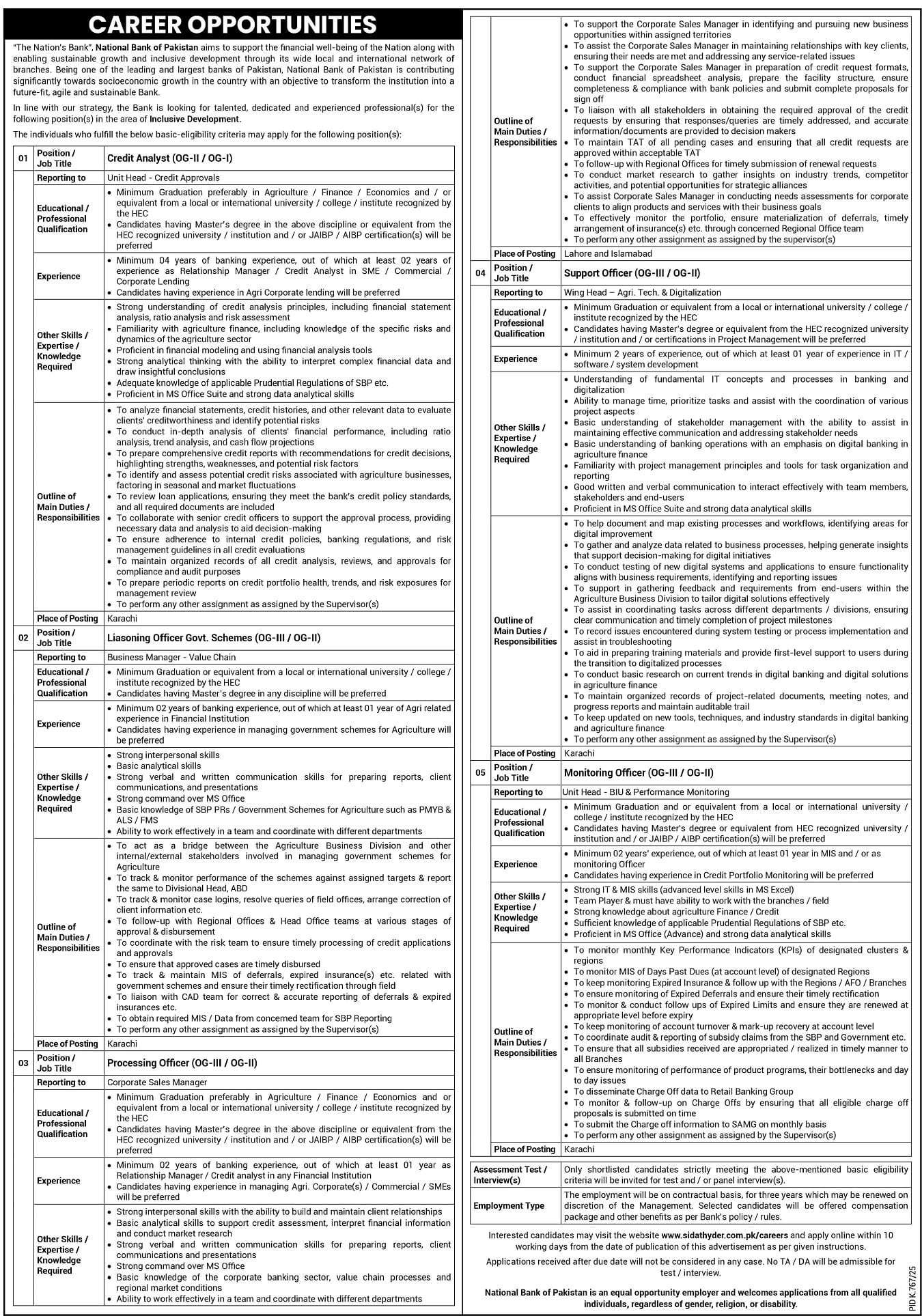

- 1. Credit Analyst (OG-II / OG-I)

- 2. Liaisoning Officer Govt. Schemes (OG-III / OG-II)

- 3. Processing Officer (OG-III / OG-II)

Career Opportunities at National Bank of Pakistan

CAREER OPPORTUNITIES at the National Bank of Pakistan (NBP) are now open, inviting talented individuals to contribute to a momentous national vision. This venerable institution passionately champions financial well-being across the nation, fostering inclusive development through its vast local and international branch network. As Pakistan’s largest and most influential bank, NBP plays a crucial role in the country’s socio-economic advancement, diligently striving to evolve into an agile and supremely sustainable financial leader. In pursuit of its ambitious strategy, NBP seeks dedicated professionals for impactful engagements within its vital Inclusive Development division.

Shape Pakistan’s Future

Embarking on a mission to transform Pakistan’s economic landscape, the National Bank of Pakistan continues its legacy of national service. Its core objective centers on empowering communities and driving sustainable growth, particularly in underserved sectors. These newly available roles are integral to strengthening the bank’s outreach and optimizing its development initiatives. An insider tip: NBP uniquely leverages its expansive rural branch network, reaching regions where other financial institutions seldom venture, making a tangible difference in people’s lives.

Explore Dynamic Roles

The Inclusive Development division at NBP is actively seeking five distinct experts to bolster its strategic programs. Each professional opening offers a chance to directly influence crucial financial initiatives designed for national prosperity. These opportunities promise significant professional growth while contributing to meaningful societal progress.

- Credit Analyst (OG-II / OG-I)This expert role involves meticulously assessing creditworthiness for financial approvals, fundamentally supporting NBP’s lending operations. You will delve into complex financial data, ensuring sound and responsible banking decisions.

- Quick Requirements

- Minimum graduation, preferably in Agriculture, Finance, or Economics from an HEC-recognized university.

- A Master’s degree in a relevant field or JAIBP/AIBP certification is highly preferred.

- At least 4 years of banking experience, including a minimum of 2 years as a Relationship Manager or Credit Analyst in SME, Commercial, or Corporate Lending.

- Strong understanding of credit analysis principles, financial statement evaluation, and risk assessment techniques.

- Proficiency in financial modeling tools and advanced MS Office Suite functions.

- Familiarity with agriculture finance dynamics and applicable State Bank of Pakistan (SBP) Prudential Regulations.

- Career Benefits

- You will develop unparalleled expertise in financial scrutiny and risk mitigation, sharpening your analytical capabilities. This assignment also offers exposure to a broad spectrum of lending portfolios, enhancing your understanding of diverse economic sectors. Furthermore, you will play a critical role in supporting key decision-making processes, directly contributing to the bank’s financial health and stability.

- Who Should Apply

- Ideal candidates possess exceptional analytical skills and a meticulous eye for detail, coupled with a deep understanding of financial markets. You should be adept at interpreting intricate financial data and formulating clear, actionable credit recommendations. Individuals with experience in Agri-Corporate lending will find this a particularly rewarding professional avenue.

- Salary Details

- Compensation for this particular role is competitive and structured in alignment with the esteemed bank’s established pay scales and comprehensive benefits framework. Specific details will be shared with shortlisted candidates during the comprehensive interview process.

- Quick Requirements

- Liasoning Officer Govt. Schemes (OG-III / OG-II)This integral position focuses on bridging communication between the Agriculture Business Division and various stakeholders, ensuring the smooth operation of government-backed schemes. You will play a vital role in tracking performance, resolving queries, and coordinating approvals for critical agricultural initiatives.

- Quick Requirements

- Minimum graduation from an HEC-recognized university, with a Master’s degree in any discipline being a significant advantage.

- At least 2 years of banking experience, including a minimum of 1 year of Agri-related experience within a Financial Institution.

- Proficiency in managing government schemes specifically for the agriculture sector is highly valued.

- Demonstrated strong interpersonal skills and basic analytical capabilities are essential.

- Excellent verbal and written communication skills are crucial for preparing reports and stakeholder interactions.

- Solid command over MS Office applications and fundamental knowledge of SBP PRS or government schemes like PMYB & ALS/FMS.

- Career Benefits

- This engagement will significantly enhance your stakeholder management abilities, as you navigate complex government and internal banking dialogues. You will gain profound insights into agriculture finance and national development projects, expanding your strategic understanding of the sector. Furthermore, the role develops your project monitoring and problem-solving skills within a high-impact environment, directly influencing the success of critical national programs.

- Who Should Apply

- This employment opportunity suits highly organized individuals who excel at fostering strong relationships and managing intricate administrative processes. You must possess the capability to coordinate effectively across diverse departments and external entities, ensuring seamless scheme execution. Ideal candidates exhibit a proactive approach to problem resolution and a commitment to meticulous record-keeping.

- Salary Details

- The remuneration package for this specific designation is attractive and adheres strictly to NBP’s comprehensive compensation and benefits guidelines. Detailed information concerning the financial incentives will be provided to successful applicants following the initial screening.

- Quick Requirements

- Processing Officer (OG-III / OG-II)The Processing Officer meticulously supports corporate sales, focusing on preparing credit requests, conducting financial analysis, and ensuring compliance with banking policies. Your efforts will guarantee the efficiency and accuracy of credit approvals and portfolio management for larger clients.

- Quick Requirements

- Minimum graduation, preferably in Agriculture, Finance, or Economics from an HEC-recognized institution.

- A Master’s degree in a relevant discipline or JAIBP/AIBP certification is a definite plus.

- At least 2 years of banking experience, with a minimum of 1 year as a Relationship Manager or Credit Analyst in any Financial Institution.

- Experience managing Agri-Corporate, Commercial, or SME clients is particularly advantageous.

- Strong interpersonal skills for client relationship building and basic analytical skills for credit assessment and market research.

- Proficient verbal and written communication skills, advanced MS Office command, and basic knowledge of corporate banking, value chains, and regional market conditions.

- Career Benefits

- You will develop exceptional skills in corporate client management and financial proposal preparation, refining your strategic acumen. This opening enhances your portfolio monitoring and risk mitigation expertise, especially in large-scale lending. Furthermore, you gain invaluable experience in market research and strategic alliance identification, contributing significantly to business development.

- Who Should Apply

- This role is perfect for detail-oriented professionals with a robust understanding of corporate banking operations and a flair for maintaining strong client relationships. You should be proactive in ensuring the timely processing of requests and adept at market analysis. Candidates residing in Lahore or Islamabad with relevant experience are highly encouraged to explore this impactful venture.

- Salary Details

- NBP offers a commendable pay package for this professional appointment, aligning with the bank’s extensive compensation policy and employee benefits structure. Full particulars regarding emoluments will be disclosed to candidates advancing through the rigorous selection phases.

- Quick Requirements

Your Next Strategic Move

At NBP, your professional journey isn’t just about a job; it’s about making a significant mark on the nation’s progress. These opportunities provide a platform for continuous learning and profound impact. The bank fosters an environment where innovation thrives and individual contributions are recognized.

- Support Officer (OG-III / OG-II)This crucial technical support position drives digital transformation within the Agriculture Business Division, assisting with process mapping, system testing, and user-centric solution development. You will be instrumental in modernizing banking operations for agricultural finance.

- Quick Requirements

- Minimum graduation from an HEC-recognized university; Master’s degree or certifications in Project Management are preferred.

- At least 2 years of experience, including a minimum of 1 year in IT, software, or system development.

- Fundamental understanding of IT concepts, banking processes, and digitalization principles.

- Ability to manage time effectively, prioritize tasks, and assist in coordinating various project aspects.

- Basic understanding of stakeholder management, digital banking operations in agriculture finance, and project management tools.

- Good written and verbal communication skills, proficient in MS Office Suite, and strong data analytical skills.

- Career Benefits

- You will acquire specialized skills in digital process optimization and enterprise system implementation, becoming adept at technological integration within finance. This engagement offers broad exposure to agricultural finance digitalization trends, positioning you at the forefront of industry innovation. Furthermore, you will greatly enhance your project coordination and troubleshooting capabilities, contributing directly to the bank’s operational efficiency and digital evolution.

- Who Should Apply

- Individuals passionate about combining technology with finance, possessing strong analytical and problem-solving skills, will excel in this capacity. You should be proactive in identifying areas for digital improvement and capable of supporting end-users through technological transitions. Candidates who are quick learners and possess excellent communication skills are particularly well-suited for this evolving field.

- Salary Details

- The remuneration for this role is competitive, reflecting the significance of digital transformation within NBP, and is fully aligned with the organization’s established compensation framework. Comprehensive salary information will be detailed for individuals selected for subsequent interview rounds.

- Quick Requirements

- Monitoring Officer (OG-III / OG-II)As a Monitoring Officer, you will vigilantly track key performance indicators, enforce regulatory compliance, and ensure the health of credit portfolios within designated regions. This role is central to maintaining financial discipline and reporting accuracy.

- Quick Requirements

- Minimum graduation from an HEC-recognized university; Master’s degree or JAIBP/AIBP certification is highly beneficial.

- At least 2 years of experience, including a minimum of 1 year in MIS or as a Monitoring Officer.

- Preference given to candidates with experience in Credit Portfolio Monitoring.

- Strong IT and MIS skills, particularly advanced proficiency in MS Excel.

- Excellent team player with the ability to collaborate effectively with branches and field offices.

- Robust knowledge of agriculture finance/credit and applicable SBP Prudential Regulations.

- Career Benefits

- You will develop unparalleled expertise in credit portfolio surveillance and performance analytics, mastering critical financial oversight skills. This assignment provides profound insights into regulatory compliance and risk management practices within a national banking context. Furthermore, you will hone your data analytical skills, becoming adept at identifying trends and contributing crucial intelligence for strategic decision-making across the bank’s operations.

- Who Should Apply

- This employment opportunity is ideal for detail-oriented individuals with an analytical mindset and a strong command of data management tools. You must possess a keen eye for financial performance indicators and an unwavering commitment to regulatory adherence. Candidates with a proven track record in MIS or credit portfolio monitoring will find this a particularly impactful professional calling.

- Salary Details

- NBP offers an attractive and fair compensation package for this important monitoring capacity, strictly adhering to the Bank’s overarching salary structures and benefit offerings. Prospective candidates who progress to the interview stages will receive complete details regarding the financial compensation.

- Quick Requirements

Advance Your Expertise

Working with NBP offers unparalleled avenues for professional development and skill acquisition in a dynamic financial environment. You will gain exposure to cutting-edge banking practices and contribute to initiatives that directly empower the nation. “True impact is found where purpose meets proficiency, charting a course for shared prosperity,” reflects the ethos of these opportunities. Beyond the immediate tasks, these roles facilitate continuous learning, keeping you at the forefront of financial innovation.

Join Our Growth Journey

The National Bank of Pakistan is undergoing a significant transformation, aiming to be a future-fit, agile, and sustainable institution adaptable to evolving market dynamics. NBP is an unequivocal equal opportunity employer, actively promoting diversity and inclusivity across all its operations, embracing applications from every qualified individual irrespective of gender, religion, or disability. An insider tip on NBP’s culture: the organization strongly invests in its people, regularly conducting professional development workshops and leadership training to foster career progression and skill enhancement among its diverse workforce.

Secure Your Opportunity

These exceptional career avenues offer a chance to join a leading institution at the forefront of national development; therefore, timely action is imperative. Only candidates who precisely match the fundamental eligibility criteria will be extended an invitation for an assessment test and/or panel interview.

- Application Deadline

- Interested candidates must complete their online submissions within ten working days from the date this advertisement was published. Do not delay your application, as all submissions after the closing date will unfortunately not be considered under any circumstances. Ensure your application is perfect and submitted promptly, well before the final hour.

- How to Apply

- Visit the Career Portal: Direct your web browser to

www.sidathyder.com.pk/careers. - Locate the Advertisement: Find the specific job advertisement for the Inclusive Development positions.

- Complete the Online Application: Fill out the required information accurately and attach all necessary documents as instructed.

- Confirm Submission: Double-check that your application has been successfully submitted before the deadline.

- Visit the Career Portal: Direct your web browser to

- Quick Requirements

- Employment will be on a contractual basis for an initial duration of three years.

- The contract may be renewed at the management’s discretion based on performance and bank needs.

- Selected candidates will receive a compensation package and other benefits strictly in accordance with the bank’s official policies and governing rules.

- Please note that no travel allowance (TA) or daily allowance (DA) will be provided for attending any assessment tests or subsequent interviews.

These openings represent a unique chance to shape the financial future of Pakistan and advance your professional trajectory within a respected institution. We eagerly await applications from driven and qualified individuals ready to embark on this impactful journey. Transform your career and contribute to a legacy of trust and development with NBP.

Frequently Asked Questions (FAQs)

- Q1: What is the initial employment structure for these roles?

- A1: All positions are offered on a contractual basis for an initial term of three years, with potential for renewal as determined by management.

- Q2: How will I be informed if I am selected for an interview or test?

- A2: Only candidates who precisely meet the specified eligibility criteria and are successfully shortlisted will receive an invitation for the assessment test and/or subsequent panel interview.

- Q3: Does National Bank of Pakistan cover travel expenses for interviews?

- A3: No, the National Bank of Pakistan will not provide any travel or daily allowances for attending the assessment test or any subsequent interview sessions.Career Opportunities at the National Bank of Pakistan offer dynamic professionals a chance to significantly impact the nation’s financial landscape. The National Bank of Pakistan (NBP), a leading and expansive institution, is actively seeking talented individuals to drive sustainable growth and inclusive development.