NBP Careers in Karachi: A Guide to Credit Management Careers in Karachi

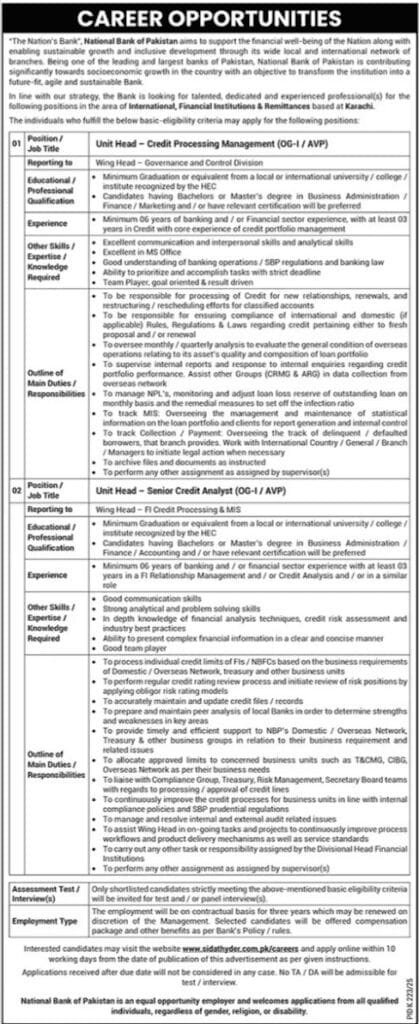

NBP Careers in Karachi, “The Nation’s Bank,” National Bank of Pakistan (NBP), as part of its strategic transformation into a future-fit, agile, and sustainable institution, has announced career opportunities for talented and experienced banking professionals. The bank is seeking to fill two key positions in the area of International, Financial Institutions & Remittances, to be based in Karachi.

Industry Overview: The Engine of International and Institutional Banking

The International and Financial Institutions (FI) division of a major bank like NBP is a critical and highly specialized area. It is the bridge that connects the bank to the global financial system, managing relationships with other banks, overseeing the credit portfolio of its international network, and ensuring compliance with a complex web of both domestic and international regulations. A career in this division is an opportunity to work at the heart of the bank’s global operations, dealing with high-value transactions and strategic credit management.

Current Market Demand

The current recruitment drive at NBP highlights the demand for skilled professionals who can manage the intricate process of credit for its international and financial institution clients. The bank is looking for two distinct but complementary skill sets:

- A Unit Head for Credit Processing Management: A professional who can manage the entire credit lifecycle, from processing new proposals and renewals to managing Non-Performing Loans (NPLs) and ensuring regulatory compliance for the overseas credit portfolio.

- A Unit Head for Senior Credit Analysis: An expert in financial analysis who can perform deep-dive credit risk assessments, manage credit ratings, and provide analytical support to the bank’s domestic and overseas network for their business with other Financial Institutions.

These are roles for meticulous, analytical, and experienced credit professionals who can thrive in a high-stakes environment.

Required Qualifications & Vacancy Details

The bank is looking to fill the following two key positions at the Officer Grade-I (OG-I) / Assistant Vice President (AVP) level.

1. Unit Head – Credit Processing Management (OG-I/AVP)

This is a key management role within the Governance and Control Division. The ideal candidate will be responsible for the end-to-end processing of credit for new relationships, renewals, and the restructuring of classified accounts within the international portfolio. The position requires a minimum of a Graduation degree, with a preference for a Bachelor’s or Master’s in Business Administration, Finance, or Marketing.

A minimum of six years of banking or financial sector experience is mandatory, with at least three of those years in a core credit portfolio management role. The candidate must have a good understanding of banking operations, SBP regulations, and banking law. Key responsibilities include ensuring compliance with international and domestic credit regulations, overseeing the analysis of the overseas loan portfolio’s asset quality, managing NPLs, and tracking delinquent borrowers.

2. Unit Head – Senior Credit Analyst (OG-I/AVP)

This is a highly analytical role within the FI Credit Processing & MIS wing. The professional will be responsible for processing individual credit limits for Financial Institutions (FIs) and Non-Banking Financial Companies (NBFCs), performing regular credit rating reviews, and preparing peer analysis of local banks. The required qualification is a minimum of a Graduation degree, with a preference for a Bachelor’s or Master’s in Business Administration, Finance, or Accounting.

A minimum of six years of banking or financial sector experience is required, with at least three years in FI Relationship Management, Credit Analysis, or a similar role. The candidate must have in-depth knowledge of financial analysis techniques and credit risk assessment. The role involves liaising with various internal departments like Compliance, Treasury, and Risk Management, and providing timely and efficient support to NBP’s domestic and overseas networks.

Employment Details and Application Process

The employment for both positions will be on a contractual basis for three years, which may be renewed at the discretion of the Management. Selected candidates will be offered a competitive compensation package and other benefits as per the Bank’s policy and rules.

Interested and eligible candidates must apply online through the official portal of NBP’s recruitment partner, Sidat Hyder Associates.

Official Application Portal: www.sidathyder.com.pk/careers

It is crucial to apply within 10 working days from the date of the advertisement’s publication. Candidates should refer to the newspaper advertisement to determine the exact deadline.

Please note that applications received after the due date will not be considered. Only shortlisted candidates who strictly meet the eligibility criteria will be invited for a test and/or panel interviews, and no TA/DA will be admissible. National Bank of Pakistan is an equal opportunity employer.

Expert Tips for Applicants

- Highlight Your Core Credit Experience: For both roles, your 3+ years of experience in a core credit function is the most critical requirement. Your CV must detail your experience in credit analysis, portfolio management, or FI relationship management.

- Demonstrate Your Knowledge of Regulations: Your familiarity with SBP regulations and international credit laws is a key skill. Mention this explicitly in your CV’s “Skills” section and be prepared to discuss it in detail during the interview.

- Quantify Your Achievements: Instead of just listing your duties, quantify the impact of your work. For example, “Managed a credit portfolio of USD X million for the overseas network” or “Conducted credit analysis for over 50 financial institutions, resulting in a well-managed risk profile.”

- A Professional Online Application is a Must: Ensure your online profile on the Sidat Hyder portal is complete, professional, and free of errors. This is your first impression to a major national bank.

Related Opportunities on SindhJobz

- Latest Banking Jobs in Karachi

- Jobs in International and Corporate Banking

- Jobs for BBA and MBA Graduates