Liaise with head office departments and regional offices to ensure the timely provision of data required for compliance reviews or regulatory inquiries, joining the Sindh Rural Support Organization (SRSO) offers a pivotal opportunity to drive impactful change. This esteemed non-profit, established under the Companies Act 2017, seeks an Assistant Manager for Risk Management & Compliance to champion organizational integrity in Sukkur.

Your Crucial New Role

This vital position contributes directly to SRSO’s reputation and its capacity to uplift marginalized communities across Sindh. Your primary mission involves safeguarding the organization from potential challenges, ensuring all operations align with regulatory standards.

You will actively support the Senior Manager in crafting, updating, and implementing SRSO’s comprehensive enterprise-wide risk management framework. Furthermore, your responsibilities include identifying, assessing, and documenting operational, financial, and compliance risks throughout all SRSO initiatives and support functions.

- Maintain and update internal Risk Registers, ensuring proper categorization, rating, and tracking of mitigation progress.

- Facilitate risk workshops and coordinate with various teams for input and validation of risk assessments.

- Monitor key risk indicators (KRIs), preparing analytical dashboards and reports for senior management review.

- Draft crucial Risk Management Reports for the RMC Committee and Board, highlighting critical insights.

- Assist in reviewing project outlines and funding agreements to pinpoint risk implications and suggest countermeasures.

- Support awareness campaigns and capacity building on risk management processes, systems, and tools.

- Monitor SRSO’s adherence to all relevant laws, including SECP, SBP, NPO, NBFC, AML/CFT Act, Companies Act, and Shariah Governance regulations.

- Maintain the Compliance Register, tracking filing deadlines and adherence to internal policies.

- Prepare compliance reports and correspondence for submission to regulatory bodies like SECP and SBP.

- Support the development of SRSO’s Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT) and Shariah Compliance programs, including risk assessments.

- Conduct initial reviews of suspicious transaction/activity alerts, preparing draft findings for further review.

- Assist in planning and coordinating essential compliance and AML/CFT training sessions for staff.

- Document and track the implementation of audit and compliance recommendations by regulators, ensuring their timely closure.

- Perform any other relevant duty assigned by the Senior Manager, fostering a supportive team environment.

Insider Tip: Proactive engagement with regulatory updates and translating complex guidelines into actionable steps are hallmarks of success in this compliance-focused role.

Quick Requirements

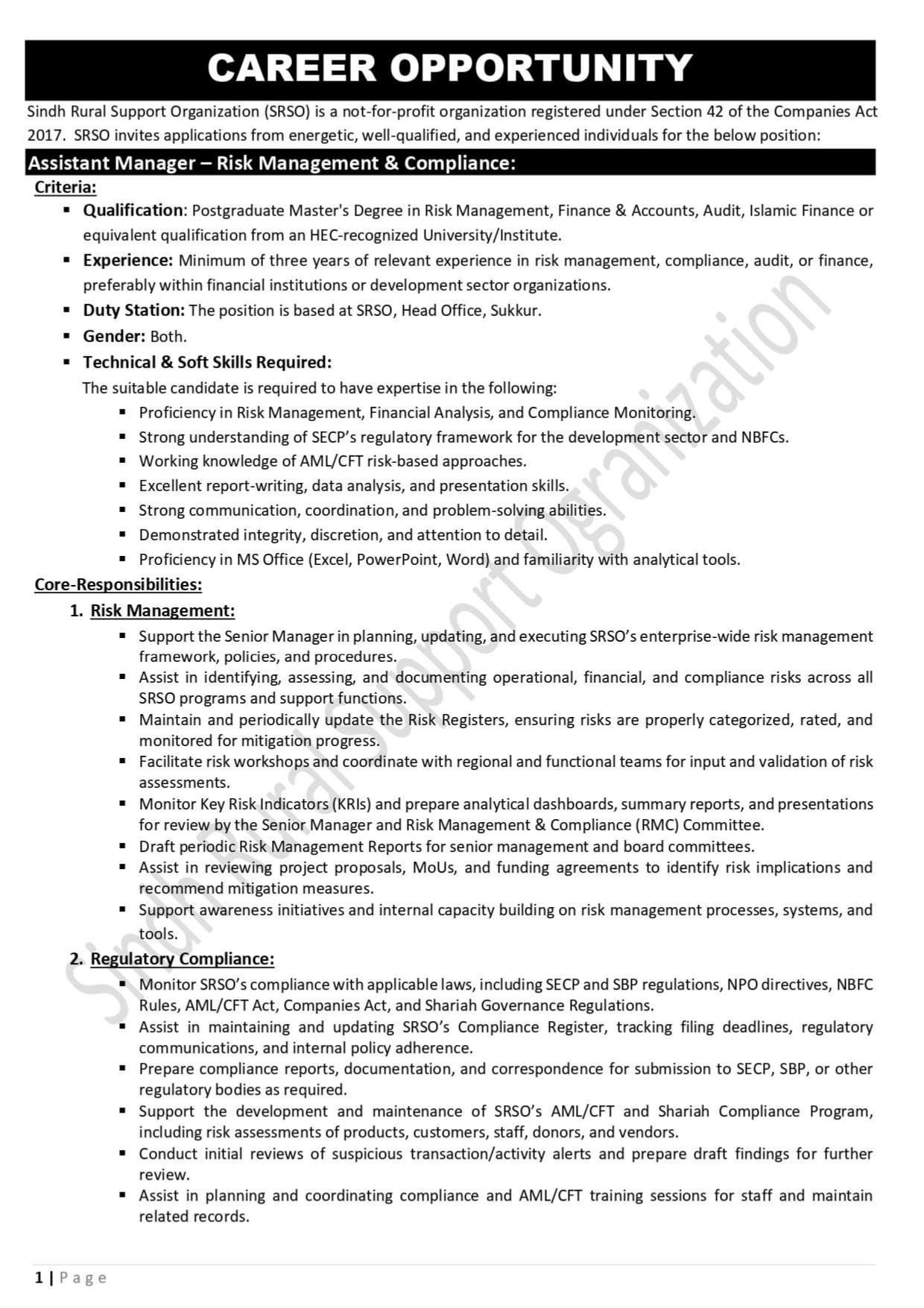

Candidates must possess a robust academic foundation, coupled with minimum hands-on experience in a relevant field. SRSO proudly champions equal opportunities for all, including physically challenged individuals and those from marginalized communities in its workforce.

- Academic Qualification: A postgraduate Master’s Degree in Risk Management, Finance & Accounts, Audit, Islamic Finance, or an equivalent from an HEC-recognized university/institute.

- Professional Experience: A minimum of three years of relevant experience in risk management, compliance, audit, or finance is required, preferably within financial institutions or development organizations.

- Location: This opportunity is specifically based at the SRSO Head Office in Sukkur, Sindh.

- Gender Neutrality: Applications are welcomed from both male and female professionals, fostering a diverse workforce.

- Essential Skills: Demonstrated proficiency in Risk Management, Financial Analysis, and Compliance Monitoring; strong comprehension of SECP’s regulatory frameworks and AML/CFT methodologies.

- Digital Tools: High proficiency in MS Office (Excel, PowerPoint, Word) and familiarity with various analytical tools.

- Core Capabilities: Outstanding report-writing, data analysis, presentation, communication, coordination, and problem-solving capabilities are paramount, coupled with proven integrity, discretion, and meticulous attention to detail.

Who Should Apply

Ideal candidates are highly motivated professionals with a proven track record in risk oversight and regulatory adherence, seeking to make a tangible difference. This career suits individuals who thrive in a dynamic, impactful setting, committed to upholding the highest standards of integrity.

Someone with excellent analytical capabilities, a knack for clear communication, and a profound respect for ethical operations will find immense satisfaction. If you are passionate about contributing to the development sector and ensuring organizational resilience, this opportunity is perfect for you.

Insider Tip: Candidates with direct experience in both financial institutions and the development sector will stand out significantly during the selection process.

Career Benefits

Beyond a compelling professional package, this career trajectory offers substantial personal and organizational development within a supportive, mission-driven atmosphere. You will acquire invaluable expertise in complex risk management and compliance frameworks within the dynamic development sector.

SRSO fosters an inclusive workplace where diverse perspectives are genuinely valued, empowering team members to reach their full potential. The organization believes in collective contributions towards a greater societal impact.

- Contribute directly to a respected non-profit dedicated to significant community upliftment.

- Develop expert-level proficiencies in enterprise risk management and stringent regulatory compliance.

- Collaborate effectively with diverse regional and functional teams across various high-impact programs.

- Access continuous learning and crucial capacity-building opportunities to further your career.

- Operate within a stable, ethical environment committed to transparency and good governance.

“This is not merely a job; it’s a profound commitment to building a more secure and resilient future for communities through diligent oversight and strategic foresight.”

Application Deadline

Act swiftly to secure this remarkable opportunity, as your comprehensive application must be submitted online before the definitive closing date. The final submission cutoff is strictly set for November 13, 2025.

Ensure all your provided details are accurate and complete; late or incomplete applications will unfortunately not be considered. False, forged information, or attempting to exert influence (Sifarish) will result in immediate cancellation of your application at any stage.

Prepare your application meticulously and submit it exclusively through the designated online portal for efficient processing. Remember, only shortlisted candidates will proceed to the next stages, and no travel or daily allowance will be admissible.

- Access the SRSO Job portal directly via https://www.srso.org.pk/careers.

- Locate the specific “Assistant Manager – Risk Management & Compliance” opening on the platform.

- Complete the entire online application form thoroughly, providing all requested personal and professional information.

- Attach your most recent CV and any other supporting documents precisely as instructed on the portal.

- Crucially, declare during your application that you have never been involved in any Sexual Exploitation Abuse or Criminal Activity throughout your career.

- Submit your complete application well in advance of the November 13, 2025, deadline to avoid any last-minute issues.

Don’t miss this impactful chance to join SRSO and play a vital part in nurturing sustainable development and upholding organizational excellence. Your expertise will directly contribute to safeguarding precious resources and ensuring ethical operations, making a real difference.

Frequently Asked Questions

Q1: What are the key regulatory bodies I’ll interact with most often?

A1: You will frequently engage with regulations from the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP), ensuring SRSO’s full compliance.

Q2: Will I receive training specific to the development sector’s compliance needs?

A2: Yes, SRSO emphasizes internal capacity building and will provide opportunities for specific training sessions focused on compliance and AML/CFT in the development context.

Q3: Is there a physical address for submitting applications or inquiries?

A3: All applications must be submitted online through the SRSO Job Portal; no physical applications are accepted.